Things have been looking grim for the once beloved celebrity Cha Eun Woo. The famous actor and ASTRO member has been caught in what is believed to be Korea’s biggest tax fraud scandal yet.

Although it may be confusing, ZAPZEE breaks down the current situation with as much detail as possible based on reporting by Dispatch. First, on January 22nd, Cha Eun Woo was suspected of $13.6 million worth of tax evasion through his mother’s company and investigated by the Korean National Tax Service. According to reports, Cha carried out his entertainment activities through an arrangement involving his current agency, Fantagio, the privately established company, and himself, with earnings shared among them.

Cha Eun Woo’s Multiple Companies and Address Changes

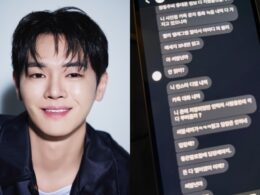

Cha Eun Woo’s tax evasion suspicions began with the joint-stock company CHAS Gallery, established on July 4th, 2019, in Dongan District, Anyang City. Cha Eun Woo served as CEO, with his mother, Choi, as an internal director and his father, Lee, as the auditor. The company handled album production, album wholesale, management, events, advertising planning, performance planning, theme parks, character creation, cosmetics distribution, food service and IP management.In June 2020, CHAS Gallery moved its address from Anyang to Tongjin-eup, Gimpo City. Two years later, it relocated from Gimpo to Bureun-myeon, Ganghwa County. The address is also known to be an eel restaurant operated by Cha Eun Woo’s parents.

According to reports, Cha Eun Woo’s mother assumed the position of CEO of CHAS Gallery in September 2020. In 2022, she then established the LLC (limited liability company) L&C. Although the names differed, the corporate objective remained the same: management.

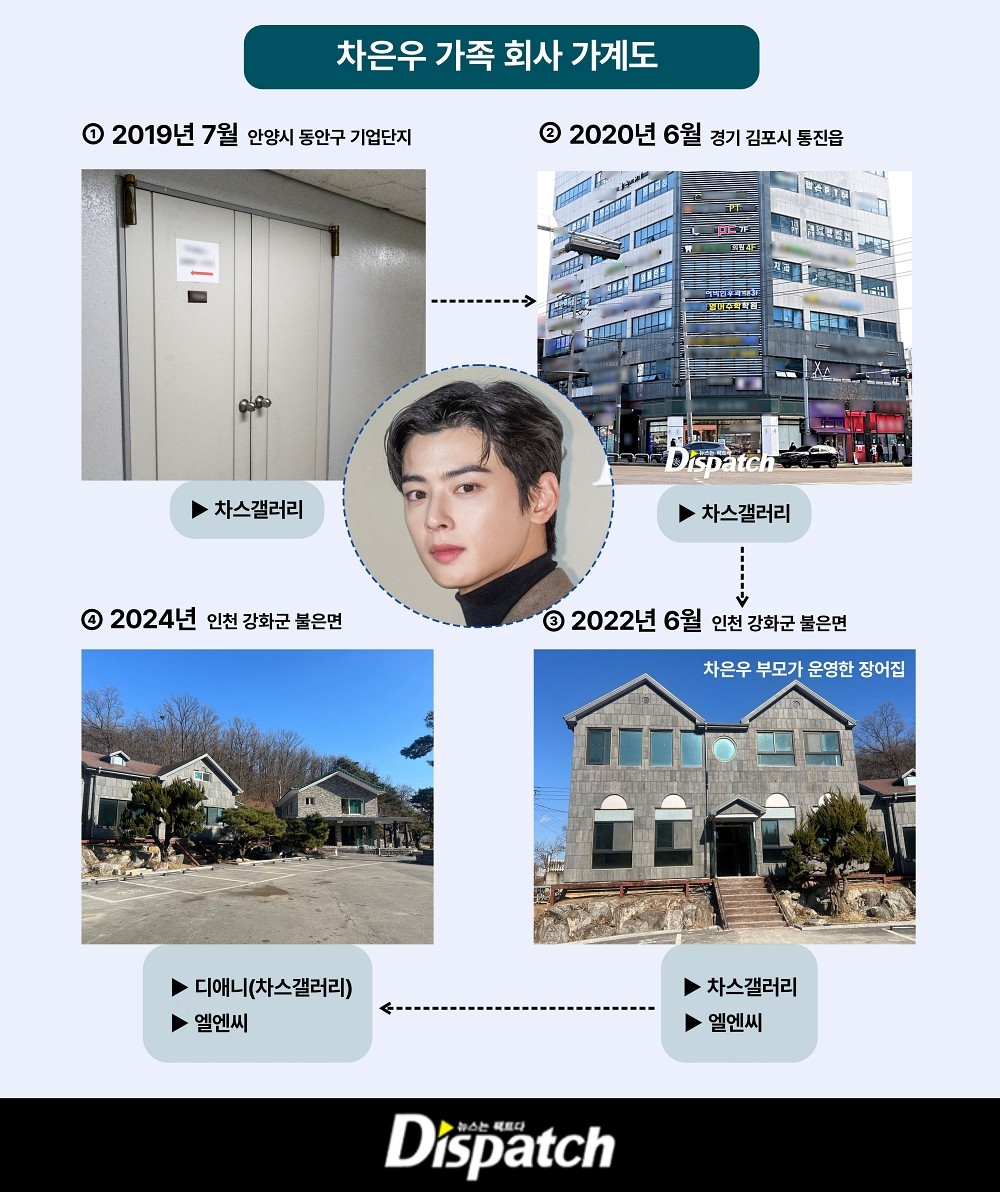

In 2024, the limited liability company THE ANNI was founded. It was created for the purpose of managing Cha Eun Woo’s assets, including real estate. While L&C focuses on practical business operations, THE ANNI is allegedly responsible for asset management and also shares the same address as the now-abandoned-looking Ganghwa Island eel restaurant.

Overall, Cha Eun Woo’s family companies changed from CHAS Gallery to L&C to now THE ANNI. The company’s legal form also changed. CHAS Gallery was a joint-stock company, while L&C and THE ANNI are LLCs. But why the sudden changes?

Why the changes + Avoiding rates

The hint that tipped off Tax Services lies in the limited liability company structure. LLC’s operate without external oversight. They also do not require external audits. Key decisions can be made simply by agreement among the members (Cha Eun Woo and his parents). Asset transactions, such as real estate or home sales, can also be conducted without disclosure. Cha Eun Woo’s alleged tax evasion amount is estimated to be around 20 billion won. However, according to reports, when calculating Korea’s corporate tax rate at 20%, the taxable profit scale is at least 100 billion won, and his actual sales could potentially be much higher.

But how did this string of events start? Fantagio also had issues and faced capital impairment. In 2016, Fantagio sold part of its shares to JC Group, a Chinese real estate and investment company. In 2017, through a paid-in capital increase, JC Group invested more capital in Fantagio and became a major shareholder in the company, owning 50 percent of the stock. JC Group then dismissed CEO Na Byung Joon, the founder of Fantagio, and put Wei Jie in his place, which resulted in several actors and key staff members at Fantagio leaving the agency.

In April 2019, Wei Jie was arrested in China on fraud charges and illegal fundraising and JC Group faced bankruptcy. During a search for a new CEO, Cha Eun Woo considered creating a personal company (CHAS Gallery) then. Later, L&C was then established after Cha Eun Woo’s mother obtained a business registration certificate in 2022, having been recognized for her alleged “experience” of working in the popular culture industry for over two years.

How The Companies Scammed The System

Cha Eun Woo renewed his contract with Fantagio in 2022 after Chairman Nam Goong Kyun acquired the company and offered Cha Eun Woo one of the highest contract fees among idols. Despite this, Cha Eun Woo still established another family company, L&C. Then, in 2024, THE ANNI was founded despite Cha Eun Woo being active as the company’s flagship artist. The private companies were allegedly manipulating earnings.

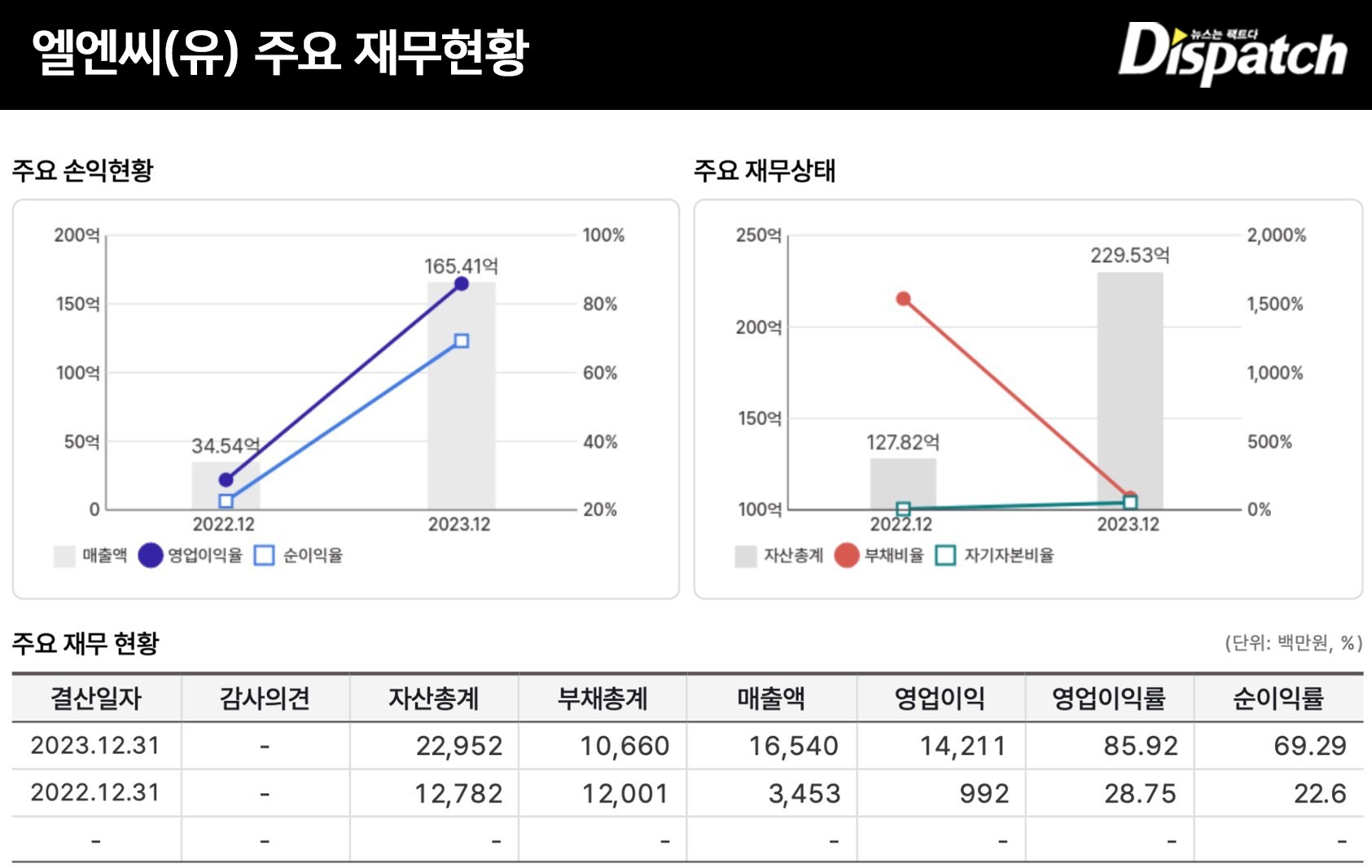

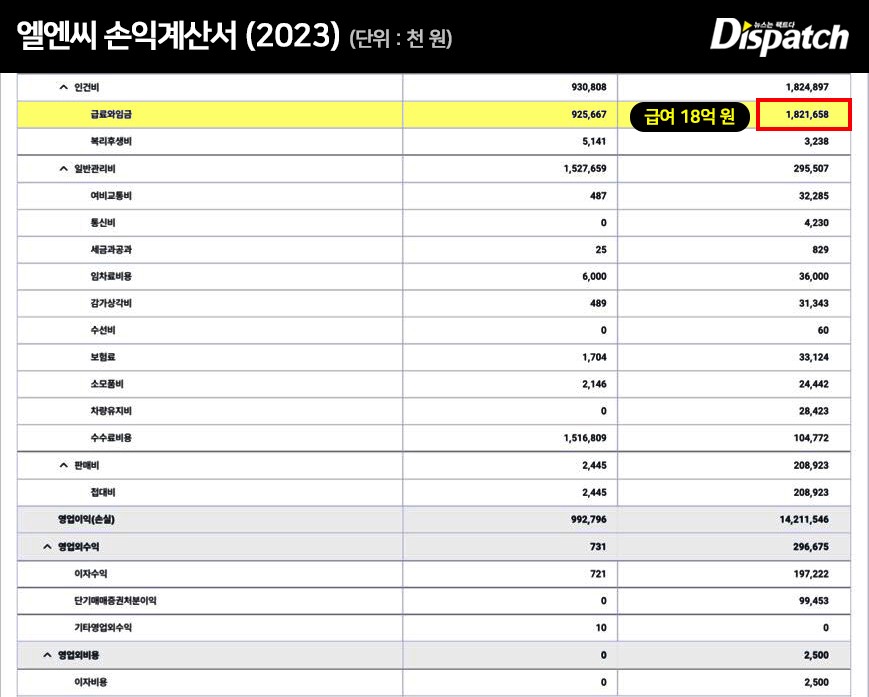

For example, if L&C were contracted for Cha Eun Woo’s filming, the family company should only receive service fees from Fantagio. However, without justification, L&C received Cha Eun Woo’s guarantee as well. This is precisely why the National Tax Service intends to collect 20 billion won in taxes. The maximum individual tax rate is 49.5% in Korea. The maximum corporate tax rate is approximately 26.4%. For high-income earners, utilizing a corporation can reduce the tax burden by about 20%. Additionally, expenses such as labor costs, rent, and lease fees can also be processed. However, it seems Cha Eun Woo and his family felt avoiding the burden altogether was the most efficient method.

>> Cha Eun Woo’s Reported Tax Case Ranked 7th Among the World’s Biggest Celebrity Tax Scandals

What do you think of the situation involving Cha Eun Woo? Will he be able to recover his idol image after this hurdle of a scandal? Can paying the taxes be enough to make things right? Stay tuned for more information and follow ZAPZEE for more update and watch trending K-dramas for free on Amasian TV!